How Does Flex Finance Work?

Flex is a spend management platform that provides businesses in Africa with a centralized approval workflow solution for managing employee expenses, vendor payments, and budgets. It offers a suite of features that help businesses streamline their spending processes, gain real-time visibility into their finances, and make better financial decisions.

Here is how Flex Finance works:

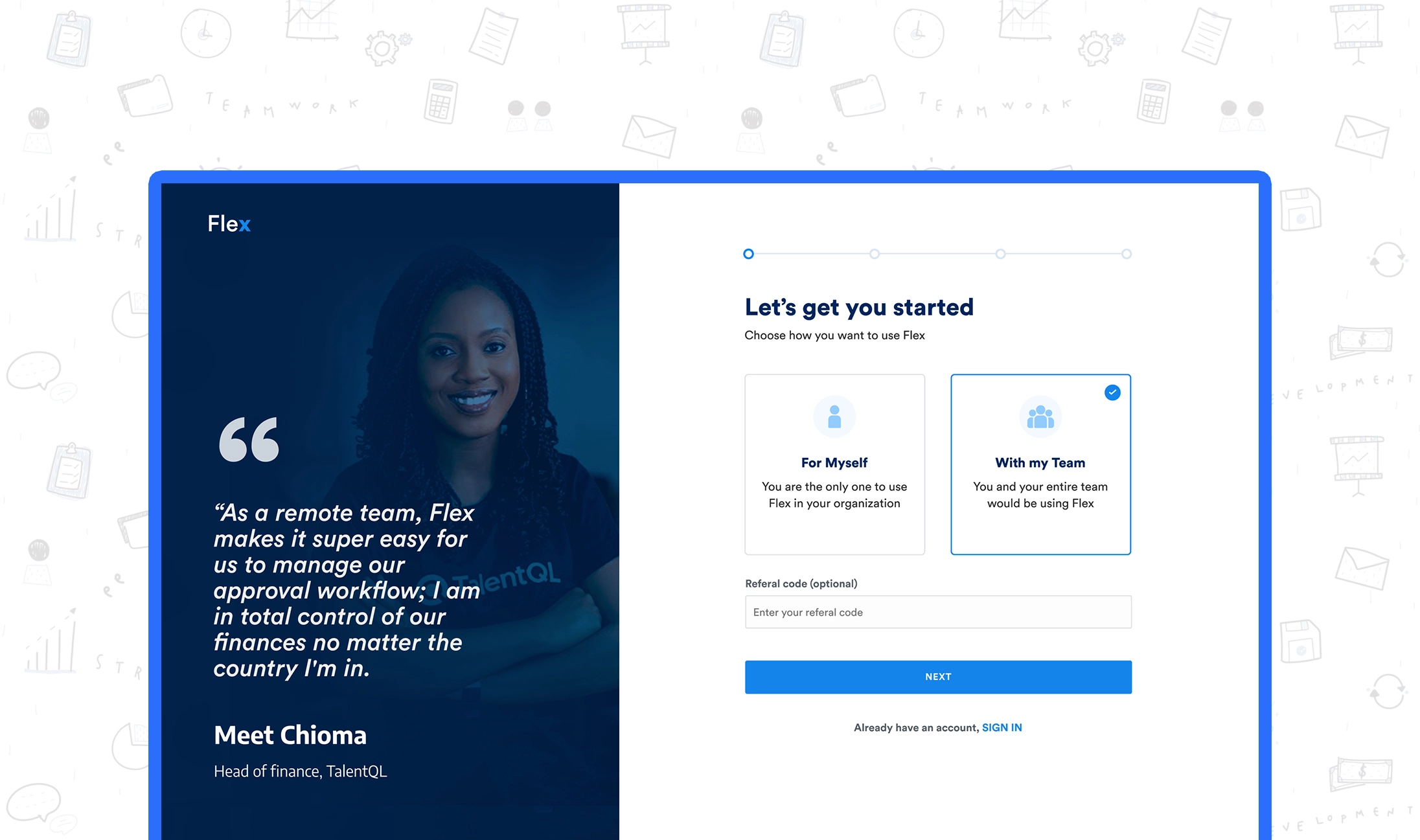

Create an account: Sign up for a Flex Finance account; onboarding is free.

Customize Your Approval Workflow: Create budgets, assign roles, and customize your spending policies.

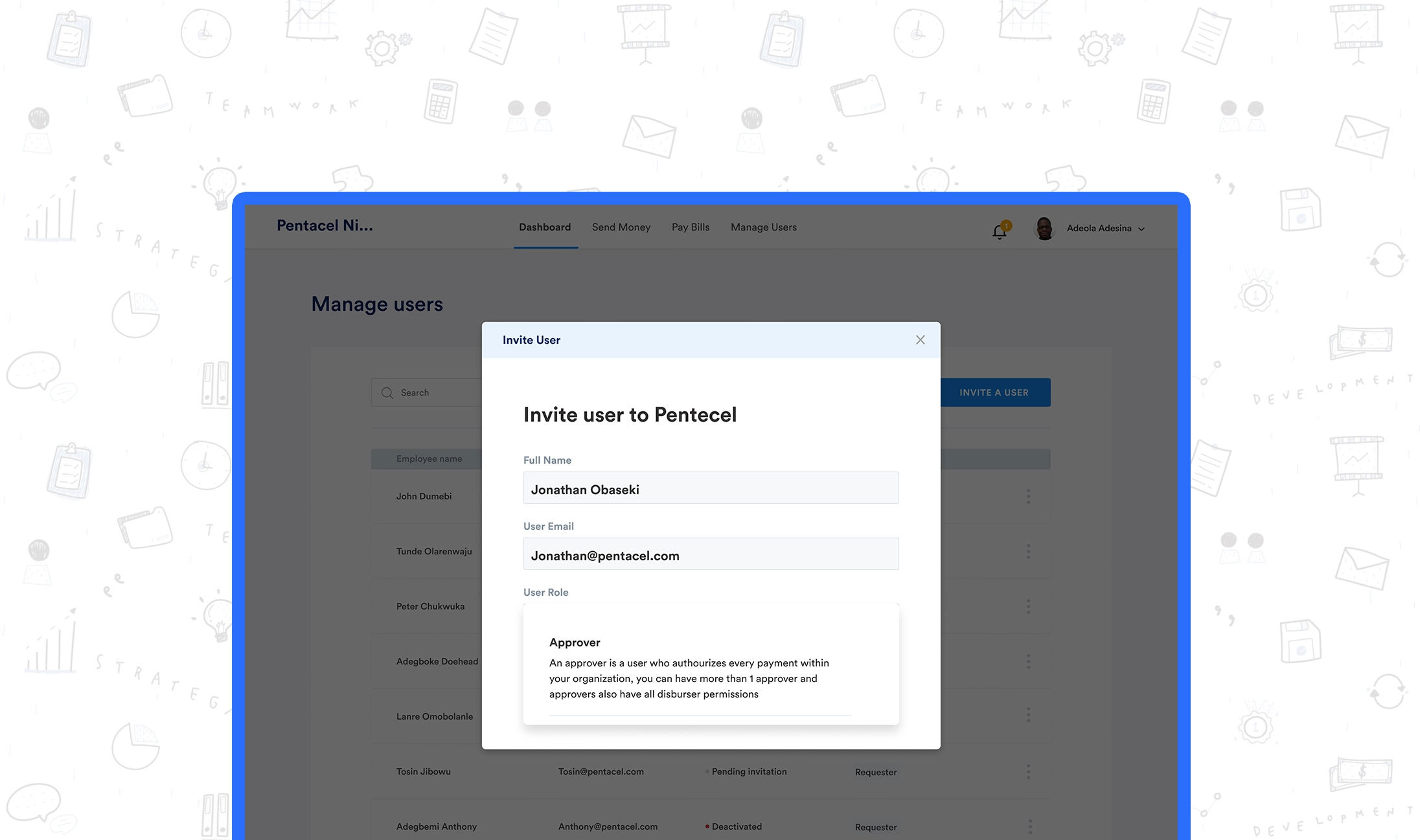

Add employees: Invite your team members to join your organization on Flex.

Issue Corporate Cards: With Flex, you can issue as many cards as your organization requires to all team members, including Ex-pats on your team. The cards come with pre-approved spending limits, and all spending is tracked in real-time.

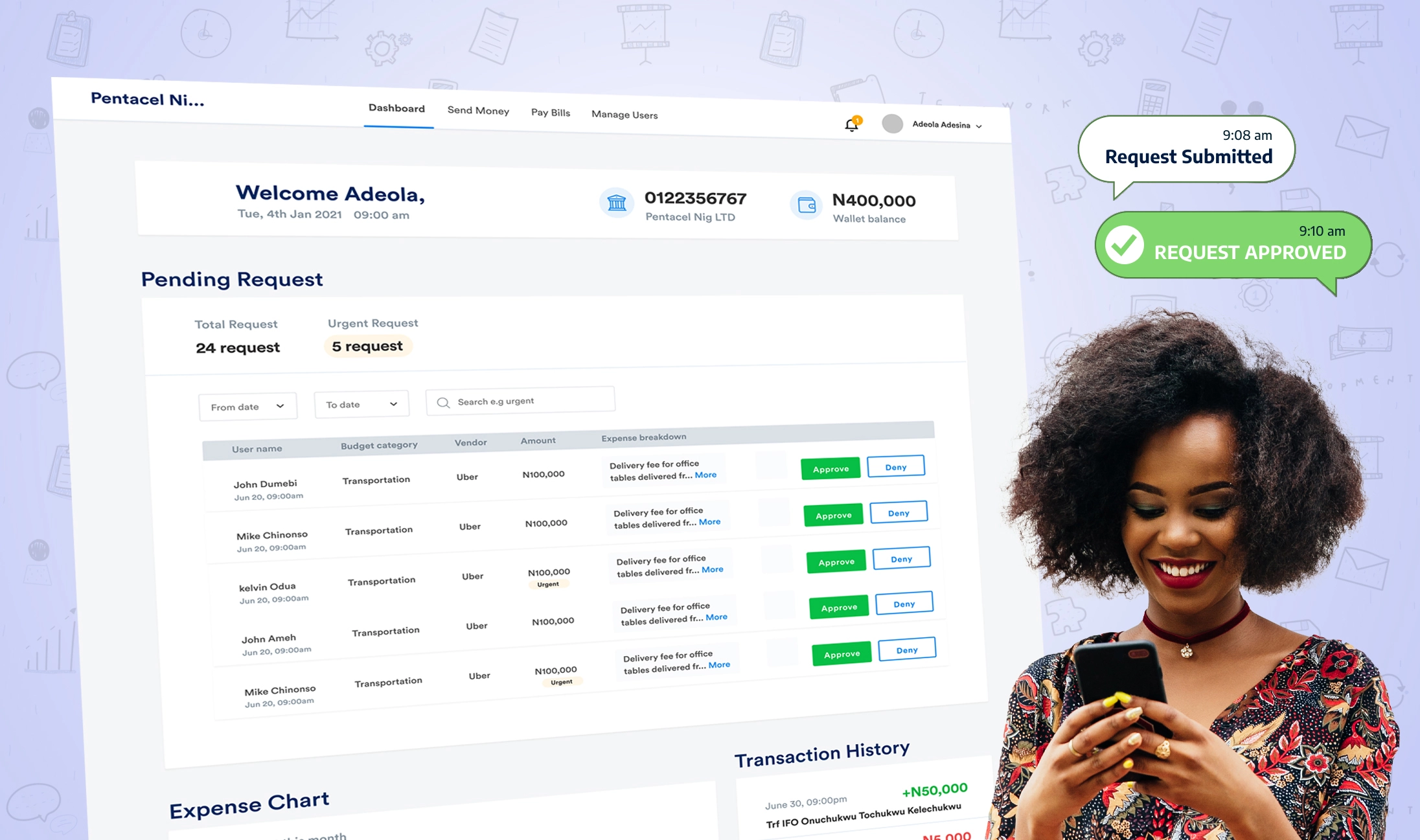

An Trackable Disbursements: Approve Payment for vendors, contractors, and employees on the go, ensuring transparent and trackable disbursements for easy reconciliation.

.webp)

Track expenses: Flex Finance automatically tracks all expenses, so you can always see where your money is going.

Expense reports: Access real-time reports and insights to track spending trends, identify areas for savings, and make informed financial decisions.

Integrations with accounting software: Flex integrates with popular accounting software like QuickBooks, Xero, etc, allowing for seamless data exchange.

Key benefits of using Flex:

Reduced manual work: Streamlines expense management, eliminating manual data entry and reconciliation.

Real-time visibility: Provides real-time insights into spending patterns and budgets.

Improved control: Enforces spending rules and budgets to prevent overspending.

Automated payments: Saves time and reduces the risk of payment errors.

Enhanced reporting: Generates detailed reports for expense analysis and budgeting decisions.

Conclusion

Flex Finance is the only platform that empowers businesses in Africa to manage company spending via mobile, web, and cards. It is a powerful tool that can help businesses save time and money, improve financial visibility, and make better spending decisions. If you are looking for a way to streamline your spending processes, Flex Finance is a great option to consider.